Bookings vs Revenues vs Billings

Measuring your business results can get really confusing. These three metrics we’re about to discuss are extremely related to each other but mean totally different things.

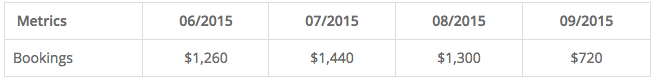

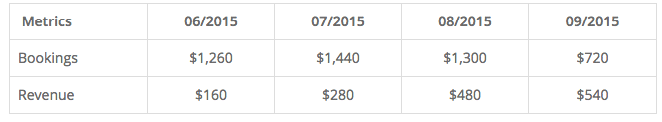

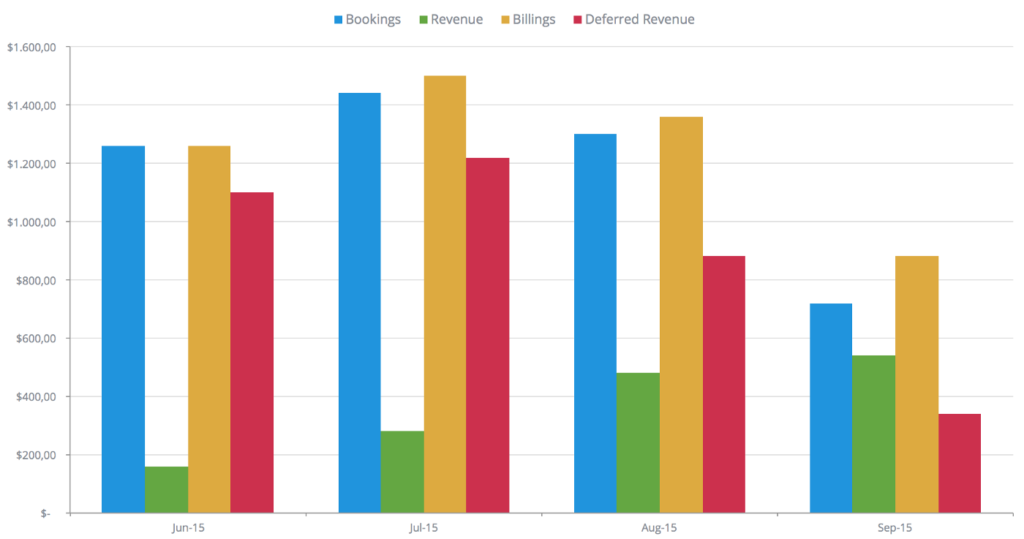

For the sake of explaining, let’s consider this sample data set of customer subscriptions.

To make things easier here, we’re considering that all customers are paying 12 months upfront for yearly plans — more on that here — which may or may not be true in your case. It’s common that companies offer customers the option to commit to a full year but still bill them monthly.

Bookings

Bookings represent the commitment of a customer to spend money with your company. That’s usually tied to a contract in the moment of the signup/subscription, that can be both be signed physically or electronically in can of full self-service platforms. To make it easier, think of booking as the contract with your customer — he signed it, but didn’t use your service nor paid you yet.

Now here’s the thing: if customer signup for a 12-month plan — in our $100/mo example — they’re committing to spending $1,200 dollars with your company, right? So that’s what you’ll consider as bookings. Your bookings for a specific month, is the sum of all the closed deals, with different prices and durations. Always consider the full duration of the contract.

Considering our sample data set, your bookings for each month would be the sum of all the contracts you booked.

Revenue

Revenue happens when the service is actually provided. Is you recognizing that money coming in in exchange for your service or product. In the case of a subscription contract, such as software-as-a-service products, the revenue is recognized ratably over the life of the subscription. So if you’re managing things on a monthly basis, each month you’ll recognize a portion of the money as revenue, 1/12 in case of our yearly plans.

Considering our sample data set, your revenue would be the sum of the portion of revenue each customer is bringing in monthly. Keep in mind we’re not considering any kind of churn nor contraction here.

Billings

Billings is when you actually collect your customers' money. That can happen at the time of booking in case they’re paying you months in advance, or at the time of revenue recognition in case they’re paying you monthly — even if committed to a full year.

Considering our sample data set, we’ll consider two things: if a customer subscribed to a yearly plan, we’ll considering his paying for 12 months upfront and bill for the total contract value — if subscribed to a monthly plan, we’ll consider the plan amount being billed every month.

Deferred Revenue

You also want to pay attention to deferred revenue. That’s money you’re already billed — and it’s already on your bank account — but can’t yet be recognized as revenue, because the product/service hasn’t been served to the customer yet. If you usually close a lot of yearly billing deals, you tend to have a high deferred revenue.

Considering our sample data set, that’s simply billings — revenue.

Conclusions

In SaaS, if you bill your customers upfront billings will be just like bookings, but if you bill monthly billings will be just like revenue. Of course it will all depends on your specific scenario, product/service and pricing schema. The important thing to notice here is how your — recurring — revenue grows over time, as you close more deals (book more revenue).

There are also other interesting relations between these metrics. One of them is the book to bill ratio. In some specific industries not all booked business can be delivered and turn into revenue, as in advertising for instance — it’s like you’re leaving cash on the table.

It’s important you keep track of all these metrics very carefully. You want to know how much revenue your company has booked, how much is your monthly revenues, and how much revenue you have actually billed. In fact, that’s even crucial to decide how to pay commissions and variable compensation to your sales reps, but that’s a topic for another post.