Locaweb, Family Business Turned Unicorn

Locaweb: A Testament to Brazilian Entrepreneurship

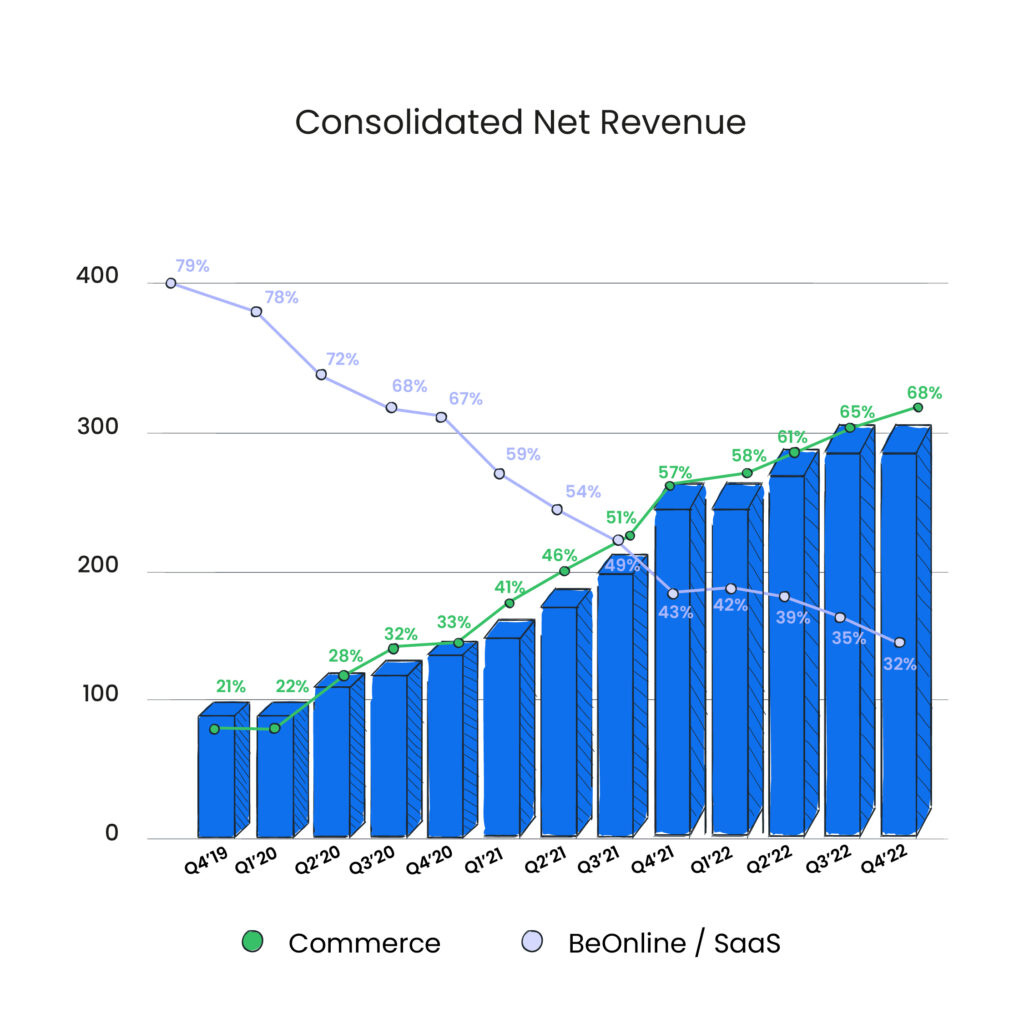

Step back in time to the 1990s in Brazil, where the idea of a homegrown hosting service company competing with global industry titans seemed like a distant dream. But defying the odds, Locaweb has emerged as a Latam SaaS unicorn, valued today at R$5,31 billion (down ~65% from its peak ~R$15 billion valuation in February 2021), boasting a yearly gross income of R$ 1,13 billion in 2022 and growing 42% year over year (YoY).

The company transacted R$13.3 billion gross merchandise value (GMV) on its e-commerce platform and partner ecosystem, a 20,3% increase from Q1'22 to Q1'23 while adding ~10,000 new users to its 170,000+ e-commerce base, and 390,000+ users to its BeOnline/SaaS vertical. The business is reaching its ~600,000 total users in a fast-paced rhythm. It's not an exaggeration to say that the Brazilian SMB and mid-market business infrastructure is heavily reliant on Locaweb's offers!

That's not all - Locaweb has generated positive cash flow since its inception in 1998 and posted a profit of R$7.2 million in Q1'23. But what's truly impressive is how Locaweb has achieved this growth, at their current scale, in such a healthy way, with an EBITDA margin of 17.1% in Q1'23 - a 3.8 percentage point than the previous year.

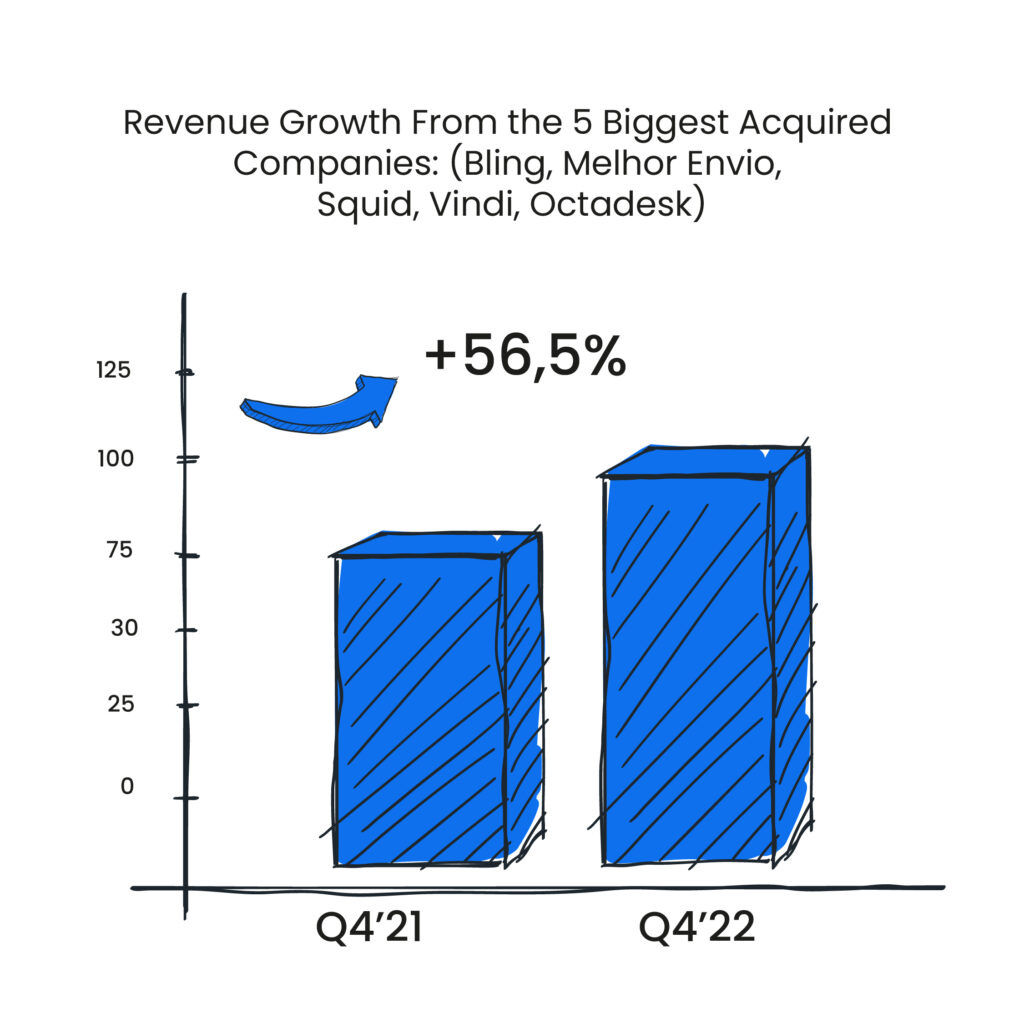

With a reputation for acquiring companies that complement its tech and business ecosystem, Locaweb has successfully integrated 20 businesses into its fold, including recurring payment giant Vindi, which saw a Total Payment Value increase of 63% YoY in the year after being acquired by Locaweb.

Put together, you'll see in the chart below the 56.5% combined revenue growth from the 5 main acquired companies (Bling, Melhor Envio, Squid, Vindi, and Octadesk) in just one year:

Today Locaweb is one of the most important players in the digital infrastructure space and one of the most active acquirers of companies in Latam. It's a remarkable success story that began when a family-owned company sought software to manage its textile business in the early 2000s and ended up creating a website hosting service that would go on to serve Brazilian businesses with many digital needs.

Born Out Of A Pivot

Founded by the cousins Claudio Gora and Gilberto Mautner, it all started with an idea to build a B2B portal for the textile sector. The company's first website is still up. Claudio and Gilberto are superstitious people, and nobody can blame them. They have not only survived the 2000's dot-com bubble burst but thrived during it.

Intermoda was their initial product: a B2B portal for the textile sector that didn't work out. Despite Intermoda not finding its expected demand in 1999, the founders decided to offer website hosting to Brazilian companies that wanted to launch their websites, after all, they needed to host Intermoda's website themselves and concluded that the market needed someone to make it easier for the non-digital businesses out there. That's how Locaweb was born.

(Funny how the textile sector had something interesting going on at the beginning of the century. If you know the story of VTEX, you know what this is about.)

Today Locaweb has 4,000 employees across the country, multiple acquisitions under its belt, and is over-delivering upon its post-IPO revenue growth promises. But even though Locaweb has grown into a major player in Brazil, it's still run by the same principles. Locaweb was built upon very strong family values, from members who work together every day to build this business.

Gilberto Mautner, the founder and early CEO, calls himself the most typical nerd you can possibly imagine. He remembers his days in 1982 when he was 14 years old, programming in BASIC using a TK85, one of the first computers to be developed in Brazil, and storing his code in a ~massive~ 16kb cassette tape - It's not old. It's vintage.

Gilberto got into one of the most competitive grad schools in the country, ITA (National Aeronautic Institute). There are only 100 vacancies a year for each course ~110 candidates per vacancy. Historically, for the 70-question test, split into different subjects, approved students must score an average of 90% on very complex math questions alone.

He was always interested in making things. That's why he went to study computer engineering, to understand the physics behind computers. Gilberto was always different as a kid. No wonder, after graduating college, he went to work abroad. Even when at the time in Brazil, it was very rare for one to do so.

While working abroad at Accenture, Gilberto was surrounded by tech opportunities. The company headquarters was in Silicon Valley and the year was 1998. You get the picture. While working at a top consulting company, he started thinking about how he could do the same in Brazil.

But as an engineer by heart and by trade, a math genius who likes to build things that work, Gilberto needed a creative partner. That's when Claudio came into the picture. Claudio Gora is an ad man and Gilberto's cousin - who he considers to be his brother. Claudio worked at his father's textile store. They had an idea to grow this existing business.

Product Market Fit By Chance

It all started as a family business back in 1997. Their goal was to find a business in order to make money and avoid at all costs becoming an employee somewhere else.

Intermoda was supposed to be a B2B portal (a very popular business idea at the time, look at AOL and Yahoo) to bring the textile industry together in the online world. It was born as a business to help textile companies build their own online stores, a fashion business network, something that was very modern at the time. Needless to say, it backfired very quickly.

They were sadly too early in the market. In 1998 the early adopters in the textile industry were only taking their first baby steps into the web. The founders clearly realized Intermoda wouldn't prosper and after only 4 months of operations, they decided to either go look for a job or pivot.

Michel Gora, their father, and an entrepreneur and investor, suggested that they changed their idea to offer website hosting to any company. A larger addressable market would make them the first to offer this in the nascent online Brazilian market. Gilberto and Claudio were young and excited entrepreneurs who accepted this challenge and began working on it right away.

It went like this: in order to have an online presence, Intermoda needed to rent a server in California to host its own website since there weren't data centers available for rent in Brazil at the time, let alone good web hosting providers.

Since their server and database were already set up and working for Intermoda's website and system, they decided to “sub-lease” the space in their California-rented server to other businesses that wanted to host their own websites.

So in January of 1998, Locaweb was officially born ("loca" in Portuguese is the prefix used in the words that mean "lease").

They shipped their idea fast, and within 24 hours they had 10 plans contracted from clients who wanted to host their websites with them. But one of those clients was a scammer—he never paid his bill. This was the first warning sign that they needed to take deeper care of new clients to avoid getting ripped off again.

Locaweb’s business model evolved to be straightforward: the company would rent server space from a third party - Embratel - and then sub-lease that space to other businesses. The company made money by charging its customers for the hosting services it provided (e.g., maintenance, technical support, etc.).

Bootstrapping all the way to international attention

Locaweb was formed with little to no pre-existing marketing plan in place. The name came from a brief exchange between Claudio and Gilberto, after which they realized a name was less important than turning around from unprofitability to success.

The pivot and name decisions were made during family conversations between the two young founders and their investor and father, Michel Gora. The most important thing was to make sure the ideas were quickly put to work and stress-tested so they could think of the next big thing.

Locaweb's first days indicated this was an idea worth pursuing. They began scaling fast! But growing at a rapid pace raises all sorts of issues. From customer service huge backlogs to office infrastructure, and even making sure there's toilet paper in the office restrooms.

So it was not long until a "white-haired experienced administrator" was required, as Claudio puts it. To level-up administration, Michel Gora was the best-suited member of the family that the young founders could rely on. He was invited to become president of their newly established company.

Their family was always present and the family members were very complementary in their skillset and work experience. Ricardo Gora, for example, today a board member in Locaweb, was only 17 when he came into Locaweb to be in charge of the company's accounts payable and receivables.

As Locaweb found product-market fit very early in the pivot, their challenge was to make sure they had enough brains and hands to keep the company profitable and growing in good health.

So, when the company grew larger and, hiring, managing, and keeping a startup culture became more difficult, Andrea Gora, their sister, became their human resources leader. She was responsible for creating their cultural guidelines for their next step in growth.

Hunger and grit were always at these founders' core. That's why bootstrapping their way to higher grounds was a natural process. Naturally, they had several challenges along the way.

Being faced with a Telecom monopoly eating into their margins and making Locaweb unprofitable for the first time in 10 years was one of the biggest.

Locaweb's First Big Challenge

Locaweb went from operating only one server to an astonishing number of 600 servers from 2000 to 2006. These servers were hosted by Embratel - the largest provider in Brazil and one of the few capable of providing Locaweb the infrastructure it needed to stay afloat.

But in 2006, many changes were happening in Telecom in Latam. One of the most important ones was the acquisition of Embratel by a Mexican company. The acquiring company saw the potential to extract more money by consolidating the market and becoming the only server provider available.

By being the only provider in the market, Embratel was able to increase prices by 3x, making it impossible for Locaweb to be profitable. It was a make-it-or-break-it moment for the business.

Not only they had to make the right decision but had to make it quick. Because that decision would either help them achieve success or put them out of business in no time.

As with many other important decisions, the entire family was involved in solving the profit margin problem. Gilberto remembers the conversation vividly, and he can still recall the tension in the air. Because they knew the only way out would take a lot of effort, and a lot of cash, and would be one of the riskiest bets they had made so far.

The idea was to build their own data centers, which seemed daunting and unfamiliar to all of them. Gilberto was a software developer who, despite his previous experience in tech, had never built a server infrastructure. Claudio was an ad man, a creative wizard that never had to dive into hardware and Michel has built his experience in the textile sector. No one knew much about data centers.

As they realized it was their only hope for success, after a lengthy discussion, they finally committed to building the data centers. Michel went abroad, hired consulting companies, and pulled all necessary resources out of their own pockets to build a data center.

Thanks to that challenge, they evolved to become one of the first companies to offer robust servers to larger enterprises, a market they weren't able to serve, until now. The change was made in only 6 months and put the international spotlight on the company for receiving investment offers.

Silver Lake, An International Validation

Locaweb had been a family business for a decade, but with the arrival of an international private equity fund, the company had to professionalize its executive leadership.

In the beginning, as the company grew, it brought in employees whose skills complemented those of existing workers. Fortunately for Claudio's family members—who were instrumental in founding the business—they hired talented professionals who could work well with people they knew personally.

But then the opportunity came to partner with an international private equity fund that would change everything forever.

It's hard not to notice how influential Silver Lake was in Locaweb's professionalization process. Not only because the partnership between these two entities lasted for a decade, starting in 2010. But if you look closely, Locaweb's quarterly reports have the same visual identity as Silver Lake's official website.

Locaweb's human-focused approach was a perfect match for Silver Lake's professionalization strategy. But not the kind that involves firing people, outsourcing tasks, and cutting costs—but rather one that emphasizes quality over quantity.

The company's focus on quality is evident in its approach. They want to create an experience that makes clients feel all their needs are being met and that employees feel they're working towards a valuable mission, not just a place where they can buy something.

This is why the company has invested heavily in developing a set of new business units that help clients manage their digital presence. A complete ecosystem.

When bootstrapping their way to this very important point, Gilberto and Claudio learned important lessons. One of them is not being reliant on only one source of income. While bootstrapping they tested many ideas to create new business units that could walk on their own.

Now, having the support from an important private equity fund they could accelerate growth from different business units by acquiring companies.

M&A is the name of the game - and Fernando is the game master

Fernando Cirne is a mechanical engineer turned technology executive, and a naturally curious person who is always interested in learning how things work - an engineer's curse.

He graduated from Universidade de São Paulo's Polytechnic School (Poli-USP) and started his career interning at one of the biggest media companies in Brazil, Editora Abril - the owner of Veja, Quatro Rodas, founder of Exame (sold in 2019 to BTG Pactual) and many others.

A pioneer by instinct, he took on a project at the beginning of the century to make Editora Abril a subscription business. In 1998 the company launched the first online sales website in Brazil and he was the steward of the project.

Fernando tells that he had to learn everything by himself: how to discover new sales channels, how to go to market, and how to manage subscription clients. By 2004, that little project that nobody wanted to take on, made Editora Abril the 6th biggest e-commerce in Brazil.

Fernando is arguably one of the most successful self-learners in the Latam tech scene. It is no coincidence that since 2012 when Fernando joined Locaweb as CMO, the M&A strategy started to take off.

Locaweb has heavily leaned into acquisitions to grow its customer base. The founders and Locaweb's leadership team, always taking into account his own entrepreneurial background, point out the fact it's not just about generating more revenue but making sure that the best of both Locaweb and the acquired companies come together, forming a unified team.

The success of the Commerce segment can be attributed to Locaweb's anticipation of the ever-changing market demands. With a focus on providing the best possible products and services to its customers, Locaweb started consolidating the B2B software market and successfully aggregating product offerings to its clients.

Since before the very first acquisition, Locaweb has strived to stay ahead of the competition and has consistently met the needs of its clients. But in 2012 with the acquisition of Tray, the first company to join Locaweb's group, the Commerce segment was officially born.

The inauguration of both the M&A strategy and the Commerce segment has since become an integral part of the company and is now responsible for generating 68% of Locaweb's revenue.

An acquisition requires extra effort and commitment, as well as an appreciation of the different dynamics and cultures between the two entities. It is essential to have a unified team capable of leveraging the strengths of each company and producing the best results. Especially if you are acquiring companies with respected CEOs that did an amazing job starting and growing their businesses.

"You can't acquire a company, give the founder an ID card and a desk and tell them what to do. You're killing their spirit" says Gilberto.

Locaweb's main goal is always to have entrepreneurial individuals at the helm of the company and to make sure that the various entities within the organization are working together. That makes incentives align, synergies between agents happen smoothly and results come naturally.

With a well-planned and executed M&A strategy, Locaweb has been able to expand into new markets and industries with speed and efficiency, rapidly boosting its growth. As a result, this strategy has enabled them to increase their profits, while developing and strengthening their corporate culture - which is no mean feat.

With these acquisitions, Locaweb was able to provide a broader range of services and products to its customers. The M&A strategy represented a significant investment for the company, aiming to expand its portfolio of services and strengthen its leadership position in the market. Something that, looking in retrospect, was one of the cleverest expansion strategies of this unicorn.

Between 2012 and 2016, Locaweb followed an aggressive expansion strategy that included the acquisition of nothing less than 6 companies. Each with its own unique offerings, its own solid customer bases, and complementarity to Locaweb's portfolio of services.

But these 6 companies were only the beginning. Gilberto and Michel wanted more, and they knew they could achieve greater growth with just the right partners.

Today, Locaweb has already acquired 20 companies. Fernando Cirne oversees the process from the beginning and is always very particular with his acquisition targets.

In all interviews with Fernando Cirne about the company's M&A strategy, Fernando emphasizes the preference for recurring revenue companies, with the possibility to cross-sell to its almost 600,000 customer base. That makes the acquired companies that are growing at 30-50% rates start growing 70% or more. Here are some examples of the most relevant acquisitions:

Tray

Tray is an e-commerce platform that was founded in 2003 at the very beginning of the e-commerce ecosystem in Brazil. In 2012, at the time of the acquisition, Tray served 4,500 clients in its base and with it 120 employees. Tray was the first acquisition by Locaweb and inaugurated Locaweb's commerce business vertical - the fastest-growing segment in the company since then.

Vindi

Vindi is a pioneer and one of Brazil and Latam's most important recurring payment companies. With an annual recurring revenue (ARR) of R$ 35 million, from more than 6,000 clients in its base, Vindi processed more than R$1 billion in collections (TPV) in the last quarter of 2020, at the time of the acquisition from Locaweb, and around R$3.5 billion in the year 2020.

Squid

Squid is the most relevant Creators Economy platform in Brazil. Their platform connects content creators and influencers to brands and helps both sides with casting, content management, and payment. Their machine learning tech enhances the achievement of campaign goals for the brands while giving voice to creators. Their annual recurring revenue in 2021, by the time of acquisition, was over R$100 million with 3-digit growth from 2020 to 2021.

Octadesk

Octadesk is a Conversational Commerce platform that helps stores communicate with their customers through an omnichannel experience (WhatsApp, chat, Instagram, e-mail, and other channels). With AI chatbots they can help these stores with a human-like customer service experience with high scalability. In 2021, at the time of the acquisition, the company had a R$25 million annual recurring revenue with 100% growth from 2020 to 2021.

Melhor Envio

Melhor Envio is a logistics integration platform that helps stores get the best deal for goods transportation. Within an extremely complex logistics ecosystem in Brazil, Melhor Envio helped more than 100,000 clients in its base with 7 million in shipping and R$ 30 million in revenue by the end of 2020, at the time of the acquisition.

All of the companies below meet the solidity and growth criteria and found a place to grow exponentially under Locaweb's umbrella:

Locaweb's IPO

"You need to be very clear about how your life is going to be post-IPO. Ours is a successful business case because we delivered the promised financial results and acquired the companies that the market was expecting us to." -Fernando Cirne

At the time of the IPO, in 2020, Locaweb had already acquired 6 companies and was capable of cross-selling and upselling their clients on multiple business fronts. At the time, its Be-Online and SaaS, along with its Commerce business fronts were responsible for more than 350,000 customers.

It's hard to pick what's most amazing data from its IPO prospectus. But starting with the solidity of its revenue stream, 98% is recurring revenue for the Be-Online and SaaS and 94% from its Commerce business.

Churn rates were almost inexistent, and the lowest in its market when analyzing similar data from competitors. While competitors were seeing up to 2% churn rates, Locaweb was registering almost half of that, at 1,2%, with only 0,6% coming from customers choosing a different company to take their businesses to.

Locaweb had an astonishing LTV/CAC ratio at the time of the IPO. The company IPO'd with a staggering 10.8x LTV/CAC from the BeOnline & SaaS front. An impressive figure, no doubt. But less impressive than the 25x LTV/CAC ratio of its Commerce vertical.

Just for the purpose of comparison, one of the best LTV/CAC IPOs from a Latam company was Nubank, with a 30x LTV/CAC ratio. And within the same e-commerce market, Infra.Commerce's IPO prospectus registered an 11x LTV/CAC ratio. Locaweb was more than double that.

With the intent of keeping the steady pace of acquisitions and furthering their business goals, Locaweb raised R$1.3 billion in the IPO, buying the entire participation of Silver Lake, the private equity investor of 2010 who owned 19% of the shares prior to the public offering.

Of the total of R$ 575 million that was available in cash, about 75% was allocated to the acquisition of companies that they had previously mapped out. They had 107 companies that had been mapped beforehand and were already in conversations with 36 of them. With this vast amount of resources, Locaweb was able to keep its promise and accelerate its aggressive strategy of acquisitions while fueling its growth trajectory.

Locaweb made a significant impact in the tech industry and strengthened its position in the commerce sector by acquiring Vindi, a highly successful player in the Brazilian recurring revenue market. This acquisition, which took place after the company's initial public offering, drew the attention of prominent figures in the technology industry, including General Atlantic (GA), one of the most notable names.

With a grounded vision and a focus on client satisfaction, GA came to help integrate its solutions. The spectacular new board member, as Mautner puts it, now owns 15% of the company and is supporting the company with its immensely valuable marketing, tech, and human resources, among others.

In a conversation with Giants of SaaS, the founder of Locaweb said he sees a lot of parallels between General Atlantic and Silver Lake. Gilberto Mautner is pleased and gladly surprised with the new partner.

General Atlantic, such as Silver Lake, has a long-term vision of how the market works, and what an important company for the Brazilian ecosystem such as Locaweb has to offer. But GA came at a different moment for the company.

Locaweb has acquired companies that have been improving product offerings and making the company an all-in-one solution for e-commerce.

Mautner has seen the stock price go up and down since then but says he doesn't lose sleep over it. He says that what would really make him lose his sleep would be unsatisfied clients and products that have less than excellent margins. If this happens, he won't be able to make the company grow and keep innovating.

That discipline comes with a price. A steady and responsible growth trajectory takes years of deep thinking and amazing decision-making skills. Mautner would know, he's graduated from one of the most competitive grad schools in Brazil. A feat that is humbly put off by him when it was mentioned by us during the conversation. Mautner recognizes he would never be able to have done it without his founding partner, Claudio.

Rodrigo Dantas, the founder of Vindi, shared insights with Giants of SaaS into the company's journey and acquisition by Locaweb in 2021 - everything Locaweb says about giving lots of autonomy to acquired founders is absolutely true.

Dantas believes that not interfering with entrepreneurs is directly correlated with the growth of the company post-acquisition. After being acquired, the founders are deeply focused on the distribution of their products and cross-selling among Locaweb companies. The compensation and incentives are well-aligned and that made Vindi grow 3x revenue after being acquired.

Vindi had many acquisition proposals on the table, even before thinking of selling. But Locaweb was the best one when they started analyzing proposals with a "long-term value generation mentality". Locaweb's plan had them as the centerpiece of the plan to integrate Vindi as a payment solution for their customer base, not to count an immense capacity to innovate within Locaweb's conglomerate of many unique assets.

Dantas gets visibly excited when talking about the future of Vindi inside Locaweb. He says Locaweb was smart to base its IPO on an M&A strategy when the market was ripe for acquisitions. He mentions important companies that are integrating with Vindi and opening a world of possibilities for innovation among them: merging with Yapay, becoming the bank for influencers offering services via Squid, and helping the ERP company, Bling:

"Take Bling as an example, which is a very unique asset. It's an unsexy business at first sight that behaves like a unicorn. If it was acquired by a bank, it would blow up big time."

The founder of Vindi is now focused on integrating all solutions that came on board in the past couple of years. He's amazed at how Locaweb is able to keep innovating and admires working with other titans of the tech industry in Brazil.

What the market is saying about Locaweb

We had to know the market's opinion on Locaweb. Giants of SaaS had a chat with a renowned investment firm that covers public tech companies in Brazil. Their experience in the tech sector provided us with many insights.

According to some interviewed analysts covering the stock, Locaweb is an extremely competent cross-selling machine. Even when the market was skeptical about it, they were able to grow and retain their client base, while increasing Average Revenue Per User (ARPU) by 16% since going public. This is all due to their efficiency in staking up revenue and Compound Annual Growth Rates (CAGR) from their M&A transactions.

Today, almost all of the company's revenue comes from sellers who use Locaweb's platform as a one-stop shop for everything they need to sell their products, from hosting to payment solutions.

But there is still room for growth. While Mercado Pago captures 100% of the GMV transacted inside of Mercado Livre, Yapay - Locaweb's payment solution - only captures 30% of the GMV transacted inside the platform.

The competition in Brazil is pretty stiff. Mercado Livre takes up to 40% of the total $35 billion marketplace market share. According to the analysts, it will be challenging to beat the logistics of established players such as Mercado Livre, Magalu, Americanas, and Via Varejo. In comparison, we must look at the U.S. where the e-commerce market is $1 trillion and Amazon takes ~50% of the market share with little to no competition coming for it.

Marketplace is the vertical they should focus on since 78% of the total revenue from e-commerce in Brazil comes from it. In the analyst's opinion, to do so, it will be paramount for Locaweb to optimize its take rate while proving its M&A spree in 2022 will improve its margins to 20% EBITDA.

Looking at Locaweb's story, we can say they're ready for the challenge. Their story is a remarkable example of entrepreneurship and innovation in the technology industry. From humble beginnings as a small web hosting company in Brazil, they've grown into a leading provider of cloud computing, e-commerce, and online marketing solutions - not to say a remarkable giant in the story of SaaS in Latam.

We could easily notice from the founders of Locaweb and acquired companies that through their vision to focus on customer service, quality products, and strategic acquisitions, Locaweb has maintained a strong reputation and loyal customer base. That is the right recipe to build a valuable and lasting business.

What's Next For Locaweb

As Locaweb continues to expand and diversify its offerings, the company faces new challenges and increased competition in maintaining its position as a leader in the tech industry. However, with its continued commitment to making a positive impact, Locaweb remains a trailblazer that inspires other entrepreneurs and startups to pursue their dreams and make a difference in their communities.

From its humble beginnings, Locaweb has grown into a powerhouse in the hosting, SaaS, and E-commerce industries. The company's dedication to innovation and excellence has allowed it to acquire 20 companies and expand its offerings to 600,000 users across multiple verticals.

The company remains committed to using its platform and resources to make a positive impact in the communities it serves. This commitment is reflected in the company's continued growth and expansion, as well as its focus on sustainability and corporate social responsibility.

The Launch Of Locaweb Company

In 2020, the company made its debut on B3 with one of the most successful IPOs in the stock exchange's history. This marked the beginning of a new chapter for the pioneering Brazilian startup, as it took strides toward becoming a significant player in the industry. As part of this transformation, they introduced a new brand - Locaweb Company.

Under the new brand, Locaweb Company offers integrated digital solutions to support businesses, providing a complete portfolio of products. These offerings range from assisting businesses in establishing an online presence and improving customer relationships to facilitating e-commerce transactions through a range of tools.

Beyond just a rebrand, this shift allowed the company to organize its portfolio more efficiently and define the roles of its different verticals, optimizing the value and synergies among them. Locaweb Company operates with a hybrid structure, where some brands collaborate closely to offer coherent solutions, while others retain more independence, providing specialized and robust solutions for customers.

Brands like Bagy, Etus, Octadesk, Tray, and Delivery Direto work in tandem, while KingHost, Bling, and Melhor Envio continue to operate independently, each contributing to the overall success of the company.

"Access to digital solutions is crucial for the development of society, and here at Locaweb, we are committed to this cause. Presenting our new global brand is a very special moment, as it shows that we are on the right path and how much we have evolved in over 20 years, walking hand in hand with technological advancements, and bringing trends so that more people could embark on entrepreneurship and growth. This only reinforces our mission, our mantra, our reason to wake up every day: to help businesses be born, grow, and prosper through technology," emphasizes Cirne.

Locaweb's IPO in 2020 was the 7th top performer of all IPOs from that year, with its stock price increasing 264.8% by Q2 2021.

As of mid-July 2023, the company is seeing a return of +18% YTD, down almost 80% from its peak in February 2021. This may be due to the recent systemic valuation corrections in tech after a couple of years of low-interest rates and abundant liquidity.

Nevertheless, Locaweb's story is one that has greatly contributed to the development of Brazil's technology industry, creating jobs and generating a positive impact on the region.

As the company continues to grow and expand, it will undoubtedly face new challenges and obstacles. But with its unwavering commitment to innovation and impact, Locaweb is poised to remain a leader in the tech industry and an inspiration to entrepreneurs and startups around the world.

This is the first edition of a series called Giants of SaaS Latam, a series portraying the untold stories behind the most valuable SaaS companies in the region. When it comes to solving complex problems with astonishing elegance, Latam founders are able to build long-lasting, solid businesses.

Locaweb's story was made by Latam founders and executives who challenged an incipient market and helped inaugurate the internet in Brazil. Its story is now told by Gustavo Souza and Leo Torres, authors of this essay.

Gustavo is the Managing Partner of SaaSholic, a venture capital firm that specializes in investing in early-stage Latin American SaaS companies, having raised $10M+ to invest in ambitious founders building category-defining businesses from idea to IPO and beyond.

Leo is the author of I'm No Economist, a newsletter covering global investment trends. Despite not being financial advice (Take no advice from me. I'm No Economist) the newsletter is read by investment professionals across VC, PE, M&A, family offices, and tech entrepreneurs.

A special thanks to Gilberto Mautner, Rodrigo Dantas, and others that participated in telling untold stories for this essay - including investment analysts from renowned firms that preferred not to be mentioned.