SaaStrAnnual 2018: Day III — SaaSholic Notes

Checkin in from Day II @SaaStrAnnual2018. My notes from yesterday can be found here. Here we go again:

Tom Tunguz & Jason M. Lemkin: The State of SaaS

On ICOs:

ICO’s are real, and are becoming a viable funding strategy;

It’s more than a consumer phenomena;

It’s a very interesting model for people looking to compete against a incumbent using centralized model. Crypto can help companies bootstrap these network effects, as you get a lot of people with vested interest in you;

Private Equity in SaaS:

Difference from VC/PE. In PE there’s no risk of failure on the business;

PE firms, such as Vista (recently acquired Marketo), buy companies set profitability/growth targets and add operational teams to execute;

In the last year, 3 thirds of exits were for non tech acquirers. I expect to see more and more of this;

For founders it is good to have these liquidity options;

These acquirers are paying almost market price/multiples from public markets;

M&A:

2017 got a 50% decrease in M&A compared to previous year. Weird year;

Top acquirers cash on balance grew to $1T. Tom’s bold predictions: Google buys Salesforce! Microsoft buys Workday!

Today you need to be substantially bigger to get calls from Corp Dev execs and M&A heads;

IPOs & Decacorns:

100m ARR, growing at 70%. That’s what you’ll need;

Decacorns are a common breed now. ServiceMax, Workday, etc;

Zendesk can reach that level, Hubspot can do that;

Busting the Myths About Startup Success with BlackLine — @Therese Tucker

Grew on a farm, poor family. They dreamt about her being a secretary. She majored in Computer Science;

Started the company out of “boredom” at her former CTO job. IPO’d in 2016;

Biggest Myths busted:

There’s no playbook for success. Stop fooling yourself;

Being a founder makes you a Rock Star. I cleaned bathroons, I did anything needed. I wanted my company to succeed;

Don’t be that guy. Humility plays. Focus on being a humble, passionate founder;

Write your own story. We spent years in the sales proccess and in the end, they sent us to procurement. It took 15 years to make it go from zero to IPO. There’s no straight line;

You don’t need to raise funding to be successful. Bootstrapping is real and possible. Teaches a lot of discipline. Bootstraping habits were essencial for our success later on;

Focus on getting customers! Success = People wanting to pay for what you do!

Hire the best to ensure success. This was not a truth for Blackline early on. Her principle was: Good, cheap or not crazy: Pick two! They loved the crazy ones!

Everything you hear about women in tech… Single mom. Doing it alone. I can hear the VCs leaving the room now. Women raise only 2% of total VC funding. You can do it and you'll be stronger for that. Women are an undervalued asset in the market. Leverage this opportunity!

Jason & Heather, WP Engine's CEO

Facing Some Difficult Truths: From burn-out to $100M in ARR with WP Engine — Jason Cohen from @WP Engine

WPEngine is now at $100m ARR, Jason built and sold other companies before;

He argues that, to build a healthier company, you have to make emotionally difficult choices;

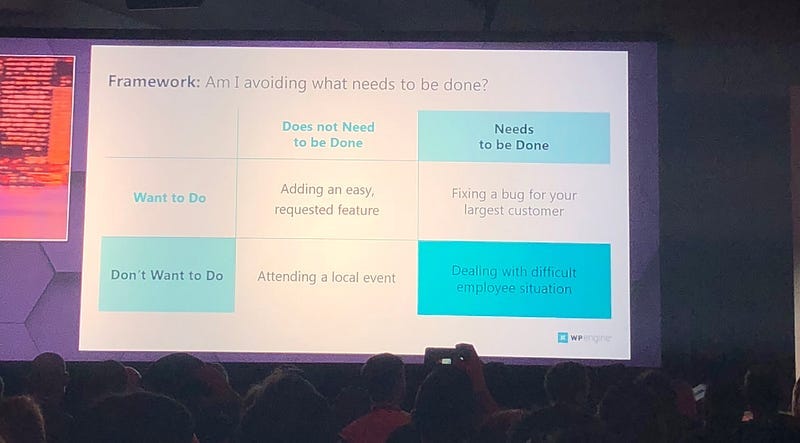

We usually delay decisions, but to understand if something needs to change now, you need to consult this matrix:

You can't become an A player at everything. When you don't hire and decide to do "by yourself", you become a C player at that skill. Don't hire people to tell them what to do. Hire them to tell you what you should do.

In your company, you need to be an editor, not a writer.

Hire people that enlighten you. Follow Zuck's rule that says that you should hire someone that you would work for them;

Hire people that are results oriented, not action oriented. It's easy to figure it out. Ask them about something that they did, if they tell you how they did it, they're action focused, if they tell you the achieved results, you'll know in a second;

Most people try to hold the CEO job, but it's ok to pass the torch to a new CEO. Most of the time you'll notice that sometimes you hold the CEO job for fear of not taking credit. That's dumb. You'll also get the credit as the founder, forever.

Jason moved from CEO to CTO. And as engineering grew to 100 people, he also decided to step off, as he doesn't love/is great at managing people. Now he's still in the company, working on projects his passionate about, and he has zero direct reports.

The best leaders let people build themselves. Be a editor, not a writer.

Fun Fact:

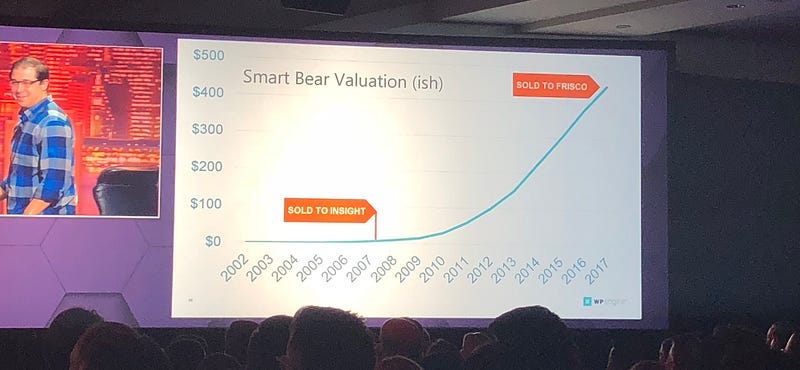

Jason Cohen sold this previous company, Smart Bear for Insight in 2007 ($20m). The company was sold again to Frisco last year for U$400m+. He'’ happy with it, as he was not happy in the company.

Up next: State of the Cloud: 2018 Edition — Byron Deeter & Kristina Shen from Bessemer Venture Partners

[embed]https://twitter.com/BessemerVP/status/961747409553387520[/embed]

Introducing the ARRG multiple: A consistent index for valuing cloud companies. Will add slides soon!

Predictions 2018:

FaaS: Function as a service, the rise of serverless computing. They increase complexity, but they also give more agility to organizations;

APIs: Continuous innovation for developer APIs that enable companies to build new products fast;

Blockchain: Will find a home in enterprise. Leadger becomes infrastructure for bigCos;

Payments As a Service: Enabling payments in empowering millions. Shopify is pioneering here;

From System of Record to System of Results: We're transitioning from focusing on increasing lock-in to focusing on increasing user results. Keeping the user away from the app is

Screenless software movement: Voice interfaces, gestures, no screens software is a huge trend;

Values differentiate: Companies with values are excelling and surpassing companies without values/culture;

The cloud is flat: Innovation is happening outside of the valley!

That's it for today folks! See ya'll next year!