Rethinking Seed Rounds in Latam: Why One-Size-Fits-All Doesn’t Work

A redacted version of our Letter from the GP

Dear Stakeholders,

Over the past decade, the Latam VC ecosystem has experienced remarkable growth, with more than 27 unicorns emerging1. These startups have created critical solutions, delivering hundreds of billions of dollars of value for society and its investors. During this period, top-quartile VC funds have outperformed every other private and public asset class in the region2, rewarding investors beyond the risks taken.

As in every market cycle, this growth has attracted a wave of new investors, many of whom often attempt to apply the Silicon Valley VC playbook to Latam’s early-stage ecosystem. We believe this is a fundamental misstep, one that is contributing to inflated seed round valuations and overfunded startups. In our view, the nuances of the region demand a more tailored investment strategy.

In this environment, we chose to stay disciplined to our fundamentals, resisting broader market excesses by making fewer investments while doubling down on our strongest portfolio companies. This approach has been allowing us to generate superior returns, while building the foundation for long-term success.

In this letter, we break down why the traditional Silicon Valley VC model doesn’t translate to Latam, the unintended consequences of this approach, and how we are doing things differently to capture the region’s unique opportunities.

Not all Seed Rounds are created equal

For better or worse, seed investing in Latam is a different game than in the US.

At the seed stage, Latam startups are nearly twice as large as their US counterparts, in terms of revenue. In many cases, investors are acquiring larger companies, with less product risk (slightly less, maybe).

A strong example from our portfolio is Jusfy, a legal tech startup that recently announced a pre-Series A round, co-led by us and Maya Capital.

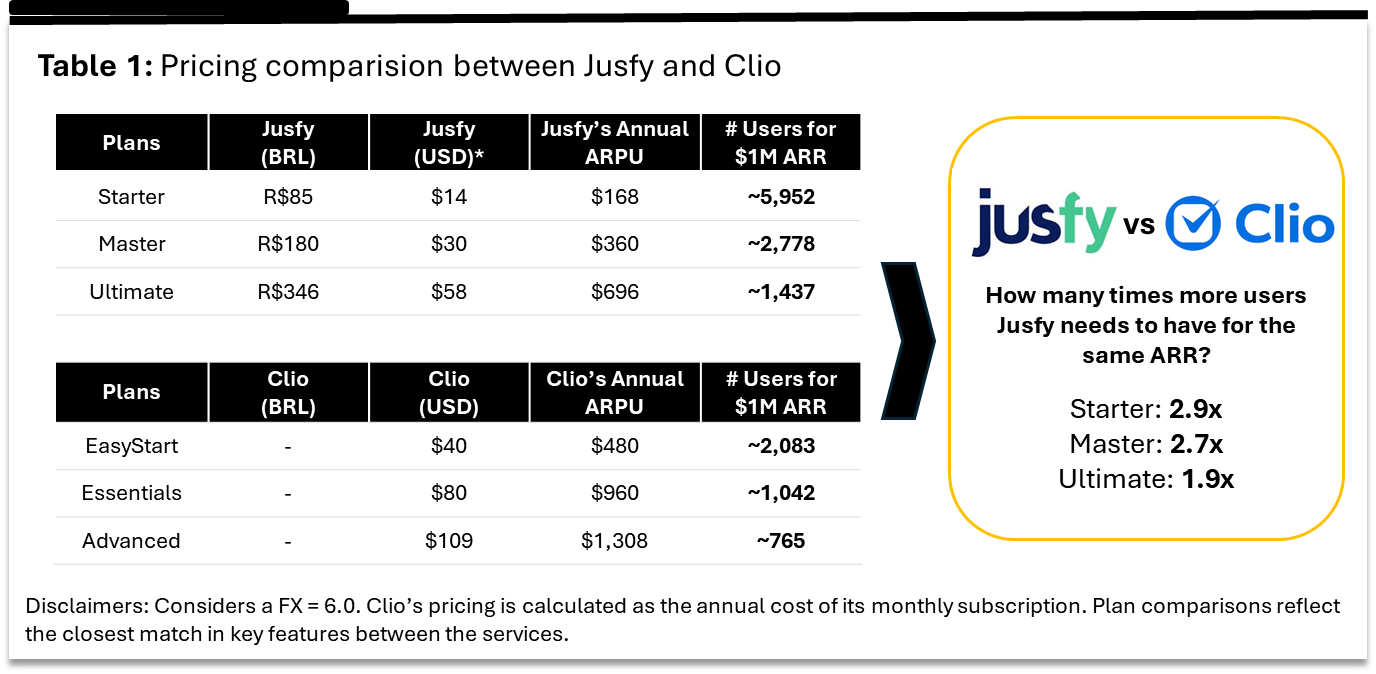

Compared to Clio, a US peer, it takes Jusfy 2-3x more customers to reach the same ARR threshold, primarily due to currency differences. While this might seem like a disadvantage, it actually results in a more battle-tested product, stronger operational expertise, and a broader base for cross-selling and upselling for the same level of ARR.

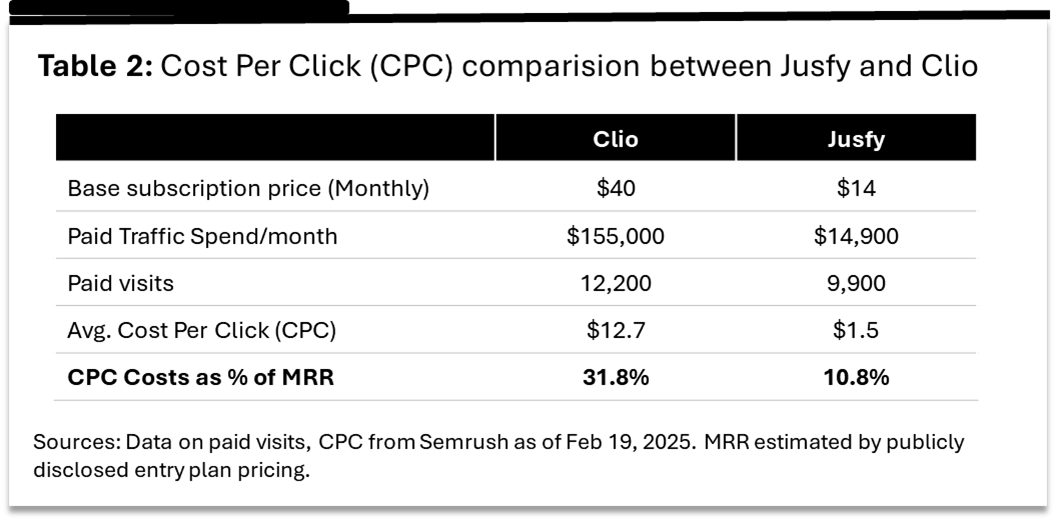

Another key difference lies in customer acquisition costs (CAC). Despite both companies deploying similar amounts of capital to drive traffic in their respective markets, Jusfy’s cost per click (CPC) is 8x cheaper than Clio’s. More importantly, its CPC as a percentage of revenue is 3x lower. This superior capital efficiency is possible because some Latam markets remain largely unexplored, with lower competition and higher ROIs, allowing startups to scale more efficiently.

Latam founders operate in capital-constrained environments, demanding efficiency from day one. Data from the State of SaaS Latam 2024 report shows that local SaaS companies consistently outperform US peers in capital efficiency, with superior LTV/CAC ratios and faster payback periods3. Many founders bypass earlier-stage funding rounds (angel, pre-seed), entering seed at a later, more mature stage with less dilution.

Certain Latam segments exhibit winner-takes-all dynamics, allowing dominant players to scale faster with less competition. As highlighted in Atlantico’s 2024 Digital Transformation Report, tech remains vastly underpenetrated in the region, and main the question isn’t if there is value to be created in Latam, but who will capture it.

These factors reinforce our conviction in the region’s potential, and we remain excited to back founders poised to capture this opportunity.

US Seed dynamics: beware, they tend not to be the same here

"The bottom line is that no asset class or investment has a lock on a high return. There's no investment that’s so good that it can’t be overpriced. And there are few that are so bad that they can’t be underpriced.", Howard Marks.

Entry price is king. Despite Latam’s strong fundamentals, many investors continue replicating US underwriting practices here.

Today, a typical Silicon Valley seed round raises $4M at a $16M pre-money valuation (20% dilution), with companies taking around two years to graduate to Series A4. However, Latam operates under different dynamics, with less capital in the asset class and structural factors that should lead to different fundraising needs.

Yet, many investors continue to apply a one-size-fits-all investment model, leading to inflated valuations, unnecessarily large rounds, and unrealistic expectations, ultimately distorting the market and putting long-term returns at risk.

A direct consequence of this approach is overfunding, as investors mirror US capital requirements without questioning whether they truly apply to Latam. In the US, a startup may need $3-5M to graduate from Seed to Series A, but in Latam - where costs are lower and competition less intense - companies often require significantly less. Talent costs alone suggest why. Salary benchmarking data shows that a mid-level software engineer (3–5 years of experience) in the US earns $120k–$150k per year, whereas in Latam, an equivalent professional earns $40k–$60k, a 50–70% reduction5.

Customer acquisition costs (CAC) follow the same pattern. As seen in the Jusfy/Clio analysis, Latam startups operate in markets with significantly lower competition, leading to more cost-effective customer acquisition, and ultimately cheaper growth. These dynamics, among others, create a structural advantage in capital efficiency, yet many Latam seed rounds are still based on inflated Silicon Valley standards.

While exceptions exist - particularly in highly competitive, consumer tech sectors - in SaaS, we rarely see deals that justify such excessive capital to reach Series A.

At the same time, we see a concerning trend of abnormally high valuations in very early-stage deals. It’s becoming increasingly common to see pre-revenue startups raising multi-million dollar rounds. We believe many of these rounds exist not to meet the company’s actual capital needs, but to fit in the portfolio construction of large fund size VCs. Some big funds are leading $2M+ in pre-seed rounds simply because it’s the smallest check they can write. Given that dilution remains relatively constant, the only way larger funds can deploy their check sizes is by driving valuations up.

While this provides founders with cheap capital in the short term, it often leads to problems down the road. Overvaluation at seed can make Series As difficult to achieve, leading to down rounds or failure to secure funding altogether—a pattern we’re already seeing play out.

In some cases, raising a large round provides cushion and de-risks the path to Series A, especially when paired with disciplined capital deployment. However, more often than not, excess capital leads to inefficient allocation, with startups prematurely building management layers that slow execution. Instead of focusing on building a superior product, founders scale too early and hire expensive talent over creative, adaptable team members. Overpaying also compresses upside for future investors, making future fundraisings more challenging. If a company falters and needs a bridge round, those funds often come on harsher terms at the worst possible time.

Another key misalignment is unrealistic exit expectations. Public markets clearly reflect a regional discount for Latam players. VTEX, a Brazilian company listed on NASDAQ, trades at 4.4x Implied ARR, while its US benchmark trades at 7.3x, despite similar growth rates and unit economics. The same applies to other Brazilian SaaS companies like TOTVS and LWSA. While public markets are not valuing local companies with US multiples, somehow some early-stage private investors are6.

As 2021-22 vintage funds burn through their remaining dry-powder7, some valuation decompression may occur. However, we can’t develop a venture investment model purely based on this assumption.

Liquidity constraints further complicate the equation. The region faces high capital costs, tax complexity and currency instability - factors that limit exit windows and create venture vintages that are highly correlated with macroeconomic cycles. Unlike in the US, where venture cycles tend to be more predictable, Latam requires a different, more flexible approach.

Why are we worried?

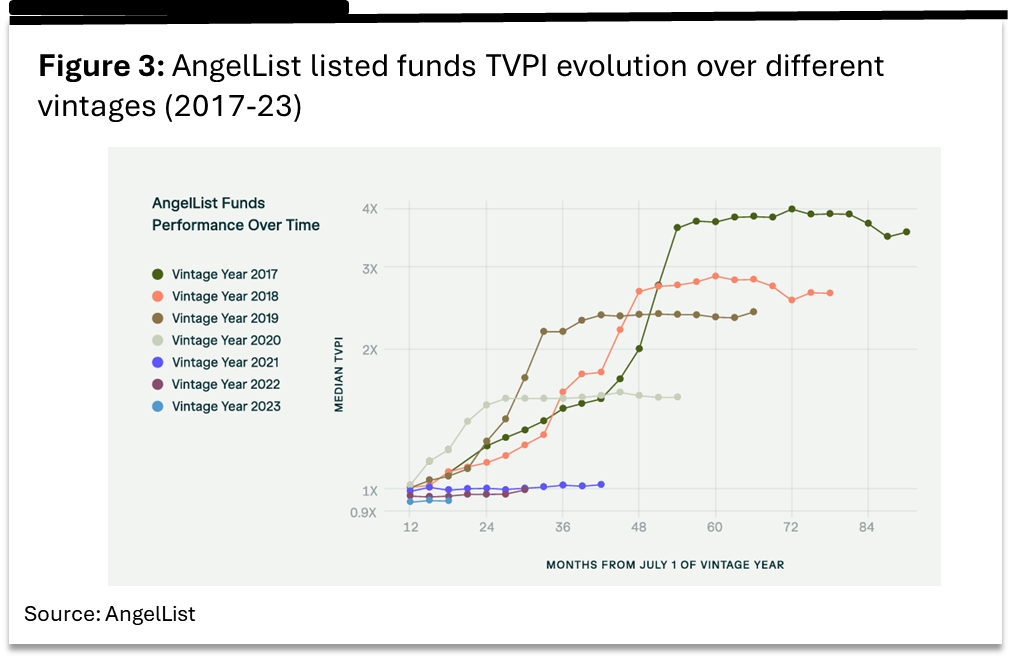

In the US, we’re already seeing new VC vintages significantly underperforming, due to irrational exuberant seed valuations over the last few years.

We fear that the same overvaluation and overfunding has also become a real trend in Latam, that will likely impact VC returns negatively over the next decade, harming founders, GPs, and LPs.

Defying the Silicon Valley approach

“Differentiation is Survival and the Universe Wants You to be Typical”, Jeff Bezos

To succeed in Latam seed investing, we believe that our investment model has to be built within the local constraints. Thus, here at SaaSholic we strive to do things our way. We don’t pretend to have all the answers - our goal is to share our perspective and foster discussions that push our ecosystem forward.

As SaaSholic, we focus on:

Real growth trajectory, not just potential market share capture.

Capital efficiency, tracking how much startups raised before seed.

Solid unit economics, avoiding capital-intensive thesis that requires speculative leaps of faith.

Solution stickiness, client retention and the ability to develop deeper product-market fit by expanding into the client’s wallet with mission-critical products.

Our Investment Strategy is somewhat simple:

Invest in right-sized rounds based on what the company needs, not mirroring US seed rounds. Some companies may need a few million, but most can graduate to Series A with $2M or less raised at the seed stage. Many can even bootstrap their way there. Scarcity fosters discipline, while abundance can kill culture and execution.

Clicksign, a company we've invested in, illustrates this principle well. By the time we invested in their seed round, the company had around $10M in revenues, despite having raised less than $1M at that point. Since then, the company has almost doubled, reinforcing the power of investing with a capital efficiency mindset.

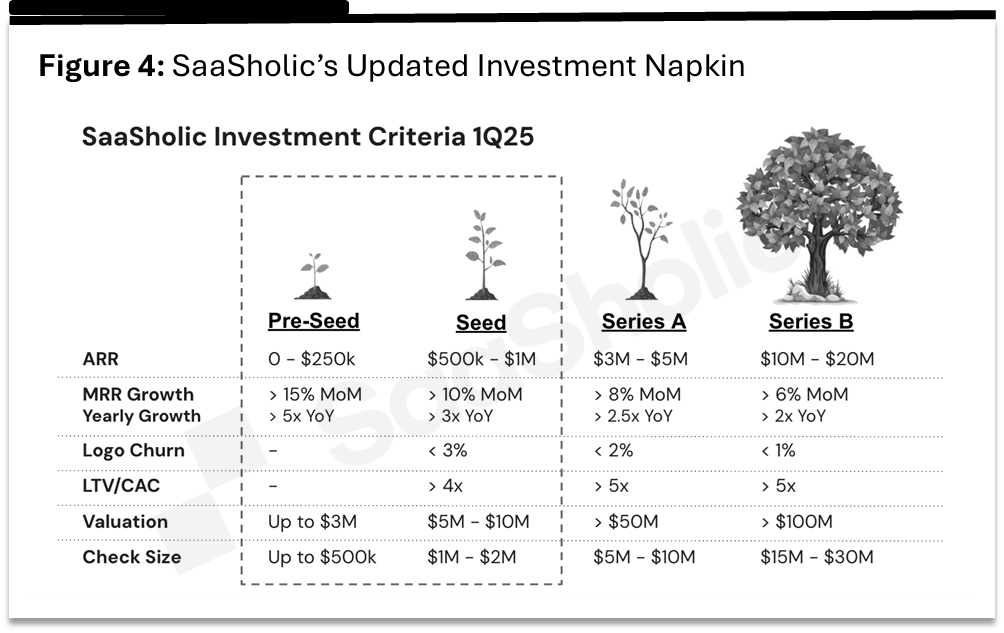

Be highly selective. Smaller rounds don’t mean we are looking for bargains nor small TAM, niche business. In fact, we invest with a significantly higher bar than most VCs we observe and closely monitor our portfolio’s success.

It’s difficult to find companies that beat our hurdles, but we prefer to invest only when these conditions align, rather than following market hype. Our “investment napkin” outlines key metrics we look for at each stage, providing a clear benchmark for the companies we back.

Due to this approach, we made only two new investments in 2024, while doubling down on high-conviction companies within our portfolio. Sometimes, the cost of being contrarian is staying out of the market.

Provide disproportionate value beyond capital. Most VCs say this, but we try hard to do it and we truly believe in this as a firm principle. Many early-stage companies need strategic and tactical guidance as much as they need money (though there are some exceptions that we also are humbled to have the opportunity to partner with).

Upon taking our funding, we take a very active, hands-on role within each company, helping with hiring key talent, improving reporting, accelerating their go-to-market and developing fundraising strategies. Don’t take our word on it, ask our founders!

Optimize for different liquidity avenues. While we invest early and take larger stakes than most traditional seed funds in Latam (at least 10% ownership in each company we become partners), we remain flexible in our exit strategy. IPOs aren’t the only viable exit path and we actively consider selling stakes to Series B/C investors once our target returns are met.

In Fund I, we partially exited our position in Conta Simples during its Series A round, generating a 10.1x MOIC at the investment level and contributing to a 33% DPI at the fund level. We have already seen some early exits in Fund II, and while not home runs, they returned capital while maintaining a 0% mortality rate to date. Paper returns are important for tracking a fund’s health, but unless they translate into real exits and LP distributions, they remain just that - paper.

Looking Ahead

We believe that when investing in seed-stage startups in Latam, VCs should develop their unique approaches rather than trying to replicate Silicon Valley in the region, which, we’d dare to say, does not seem to be working.

We are seeing a lot of hype in deals, too often, which risks diminishing returns and damaging the credibility the venture capital asset class has built in recent years.

Despite the frothy market, we remain impressed by the new generation of founders building high-growth, capital-efficient businesses and seizing unique opportunities in our region. At the right price, we remain extremely bullish on early-stage investing in Latam and are committed to supporting startups where we can add real value.

We look forward to partnering with Latam's next software leaders.

Thank you for your trust.

- SaaSholic Team

This is a redacted version of our Letter from the GP from 4Q24, and does not include sensitive information due to confidentiality reasons

Atlantico – Latin America Digital Transformation Report 2024. 33 unicorns in 2024 vs 6 in 2019.

Atlantico – Latam VC funds have overperformed fixed income (CDI), local public equities (IBOV), global public equities (S&P 500) in USD during 2012-22 vintages. Spectra – Performance of Brazilian PE and VC Fund 1994-2022 – VC funds have overperformed PE funds during analyzed vintages.

State of SaaS Latam 2024 - “Most top-decile respondents report CAC Payback Periods that are 32% lower than US benchmarks. This suggests that LatAm markets are far from being saturated vs. some more mature markets”. Anna Piñol – NFX. LTV/CAC in LatAm is at least 2x higher than the US across all stages since local markets are less competitive for customer acquisition and VC funding is scarcer.

The rise of remote-work headhunting firms further validates this, consistently positioning Latam as ~50% cheaper for hiring. Examples: Near, beecrowd, DistantJob.

Benchmark: Meritech SaaS Index, as of Feb-2025

LAVCA - Startup Ecosystem Insights 2024. 2024 marked the worst period for VC fundraising in the past seven years. 40% of VC-backed startups in Latin America last raised funding in 2021-22. Considering typical startups need between 12-18 months of runway, a significant number of startups will likely come back to market.