The Next Frontier: Super Intelligent Software

A redacted version of our 1Q25 Letter from the GP

Ever since Satya Nadella suggested that 'SaaS is dead' in the era of AI, our community has been wrestling with what that means. At SaaSholic, this question hits close to home.

Over the past quarter, we went deep into this question. We published the LatAm AI Benchmarks, met with founders and investors across San Francisco, New York, and São Paulo, and spent time with teams building in the field. This letter provides our structured perspective on the topic.

Our view is simple: SaaS is not dead. SaaS is evolving and compounding. And most importantly, it's accelerating as AI infrastructure evolves. The Software as a Service model was the largest creator of $2–20B exits in the last decade, and we expect even more and larger exits in the decade ahead.

We’re extremely bullish on how AI is propelling the SaaS business model, and see this moment as a generational opportunity in software investing: Super Intelligent Software.

To ground our vision, we’ll briefly revisit the path that brought us here and how SaaS has been declared dead and reborn multiple times over the past decades. We’re not here to retell history, but to distill the lessons that help us see what will change, what won’t, and why that matters.

The Compounding Evolution of Software

If we can learn one thing from its evolution, it's that software doesn’t leap forward, it layers. Each phase in software’s history builds on the last. From cloud infrastructure to AI-driven agents, we’ve seen a steady march toward intelligence and autonomy. This journey mirrors AI’s own trajectory, going from task-specific towards the promise of superintelligence. Along the way, each layer of progress has laid the groundwork for the next in the “Intelligence Stack".

Software as a Service, The Cloud Awakens

In 1999, Mark Benioff announced Salesforce CRM and started campaigning for the “end of Software"1. The old was dead, and SaaS became the new king, dethroning the incumbents like Oracle and Siebel. Cloud-based SaaS enabled scalable, up-to-date, always-on access to software. Businesses standardized their workflows and connected their operations via horizontal and vertical tools. These weren’t intelligent systems, but they created structured data and digital workflows that would become the bedrock for everything to come. We think of it as the pre-intelligence world.

BI Era: From Infrastructure to Business Insights

Once Cloud made data accessible and standardized, the next wave was business intelligence (BI). Tools like Tableau (acquired by Salesforce) gave companies dashboards, charts and alerts. Software could now reflect business performance, although it could not act on it. The BI era made data-driven culture mainstream. It also began teaching users to think in metrics, models, and patterns. Data could now be consumed by humans, to enable them to make better decisions.

SaaS applications suddenly had to rush to incorporate BI and reporting features, as these became table stakes. Those who didn't adapt, died. Most successfully adapted and thrived. BI made SaaS apps more powerful, but still passive. It was a step towards making people smarter, not smarter systems.

AI-Enhanced Software: The Narrow Intelligence Era

With the rise of foundational models, such as GPT-3, software became intelligent within constraints. AI copilots that could generate text, respond, or classify data emerged.

This was AI embedded into everyday tools. We got AI copilots: great at specific tasks, limited in scope, such as: summarizing documents, flagging anomalies, improving search.

And once again, SaaS evolved and became able to provide AI's signature feature: conversational interfaces, enabling the combination of structured and unstructured data to augment these apps. Very few SaaS players died simply due to this new layer. But still, AI enhanced systems are only assistive, and there's always a next step.

Intelligent Software Era: From Tools to Agents

We believe we're living in this phase right now. Software is starting to connect the dots and it's becoming smart. By leveraging the intelligence and knowledge of foundational LLMs, agents can now act on the users’ behalf, providing applications with the ability to react and reason across workflows.

Most AI Agents today illustrate a clear example of Broad AI2 in action: early-stage task orchestration with memory, context and the ability to use different tools, including software apps.

With this technology broadly available, software applications started incorporating agents everywhere, and it's clear that they are on the way to becoming pervasive.

Agents are Taking SaaS to New Levels

There is a growing belief in the market that SaaS and AI agents are mutually exclusive and that the rise of one marks the decline of the other. We believe this is a false dichotomy.

Agents by themselves are far beyond copilots, but when they are not fed with tons of proprietary data to keep evolving, they remain inherently fragile. They behave more like platform features than true solutions.

Some early agents might deliver impressive short-term value, but by lacking the infrastructure to sustain their evolution, several of these products are becoming the so-called "vibe revenues3" businesses, tools that deliver short-term results, but fail to retain customers over the long term. We're not particularly interested in this subset.

On the other hand, we also believe that many players of this “intelligent” or “agentic software” era will eventually graduate to superintelligence, and that's the opportunity that excites us the most today: Software that collects massive volumes of proprietary data, has deep network effects and clear control points, being augmented by AI agents. We believe that these applications have a shot at developing agents that will have deep domain mastery, being at least an order of magnitude smarter (and in the future, cheaper) than foundational models. That's how we bridge to Super Intelligent Software.

Super Intelligent Software: The Endgame of Work

“We’re at the beginning of a new Industrial Revolution. But instead of generating electricity, we’re generating intelligence… [Open source] activated every single company. Made it possible for every company to be an AI company” — Jensen Huang, NVIDIA CEO

Each software era unlocked new value. Now, for the first time, we are combining every moat, pricing model, and delivery mechanic into one compounding system.

Super Intelligent Software is no longer a layer around the work. It does the work.

Super Intelligent Software combines deep vertical expertise, proprietary data moats, and AI to autonomously perform complex business processes with precision and context no general-purpose model can match. It’s specialized, self-improving, and outcome driven.

Unlocking Super Intelligence

Today, client expectations have risen, and software is expected to have a baseline “IQ” equivalent to ChatGPT. Companies seeking true differentiation have already started training LLMs with proprietary data, connecting generic intelligence with industry-specific capabilities. This evolution particularly excites us. It sets the stage for a new kind of software: systems that do the work themselves, with expert level intelligence and are able to keep learning and improving, autonomously.

The road towards superintelligence is paved by leveraging foundational LLMs as commodity infrastructure and augmenting them with proprietary insights, becoming orders of magnitude superior to foundational LLMs in their specific tasks. As they evolve, these systems can adapt to real-world scenarios and deliver outcomes exceeding even the top 1% of professionals in their fields.

The Budget is Shifting: Labor and Services Spending Moving to IT Pockets

In past cycles, software was purchased by IT and measured through license counts and uptime. In Super Intelligent Software, budgets are expanding to cover entire workflows and job functions. Instead of marginally boosting productivity, these systems are beginning to take over meaningful parts of the workforce, reducing the client's labor and professional services costs.

Morgan Stanley surveyed CIOs to understand how AI budgets are being funded4. 41% reported net new spending in AI initiatives, and 35% pointed to existing software budgets. This indicates that most of the money fueling this shift is not cannibalizing current software spend, but likely coming from other sources, such as labor and services. These are the early signs of a broader reallocation of corporate spend at scale.

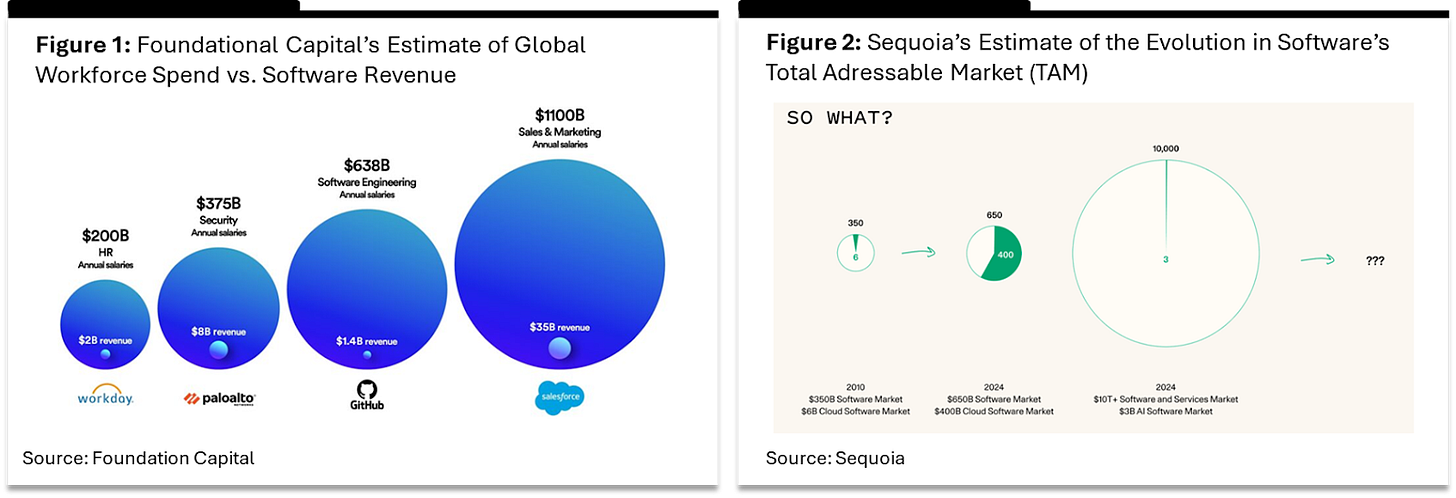

This shift expands software’s TAMs by an order of magnitude, reaching domains that were historically unreachable. Quantifying the opportunity, the current enterprise software market is estimated at $650B, while Foundation Capital places the white-collar labor market at $8.5T (13x larger)5. Sequoia is even more optimistic, estimating the combined Services + Software opportunity at $10T (15x larger!)6. While the exact number is uncertain, the size and direction of the change are undeniable, and the budget shift is already starting to happen.

If a software can replace a human being who costs $100K/year, wouldn't it be expected to capture a piece of these productivity gains?

New Systems of Record

Traditional SaaS brought us structured databases and systems of record. CRMs, ERPs, ATS platforms, and other software applications became the organization's databases for each functional area.

Super Intelligent Software creates a whole new system of record. They go beyond recording and reading transactions by also tapping into unstructured data. Traditional data silos lose importance as connectivity between systems becomes fluent in this new era. Structured and unstructured information can now be combined into a cohesive, evolving memory.

As memory and proprietary data compound, these applications capture the inputs needed to continuously evolve and train Super Intelligent, industry-specific LLMs.

Structured data tells you what happened. Unstructured data explains how and why. That difference is critical. In this new era, memory is becoming the new moat.

The Impact on Incumbents

The journey towards Super Intelligent Software is forcing incumbents to rethink their core business logic. Legacy, seat-based products designed for human-in-the-loop workflows are being disrupted by AI-native systems delivering outcomes instead of interfaces. Products such as Agentforce, by Salesforce, and Zendesk's AI agents already charge per AI support ticket resolution. Leaders aren’t asleep at the wheel. In his now-viral memo7, Shopify CEO Tobi Lütke called for a radical focus on AI. Salesforce continues to acquire AI startups and roll out GPT-powered features, while HubSpot is embedding AI copilots into its CRM.

The war for talent is just as fierce. Acquihire multiples have exploded: from ~$2M per AI engineer a decade ago to $10M+ in today’s market. In 2008, Microsoft acquired Powerset for $100M; today, we believe that a comparable team would likely command $1B+. Recent AI-native targets like Windsurf and io8 show how incumbents are buying capabilities they can’t build fast enough.

Vertical Focus is a Shortcut to Superintelligence

We think most winners from this next wave will come from the application layer, particularly in vertical, labor-intensive markets where context and outcomes matter most.

By vertical, we mean companies focused on either a specific industry (i.e., restaurants, law firms, hospitals) or on highly specialized use cases that span multiple sectors (i.e., credit collections, payroll, vendor onboarding). These are the environments where general-purpose tools can’t compete because success requires capturing role-specific data and creating systems that outperform humans.

The opportunity here is clear: Developing a vertical specific superintelligence. Vertical players have natural data gravity, positioning themselves perfectly to develop AIs that are 10x superior to foundational models.

We also believe that most horizontal, generalist AI agents are likely to be absorbed by Big Tech or foundational model companies. They have both the incentive and infrastructure to embed broader use cases into their platforms, but won’t address the long tail of industry-specific or role-specific needs.

If the last cycle produced over 300 SaaS unicorns9, we expect the Super Intelligent Software wave to exceed that by a wide margin.

Latin America's Strategic Position

We believe Latin America is one of the most compelling geographies for building and investing in this new category. The region remains underpenetrated by traditional SaaS, faces a bottleneck of knowledge workers, relies heavily on manual labor, and is full of vertical workflows that are regulation-heavy, repetitive, and ripe for automation. Latin America is simply too big to be ignored. We are a region of over 600M people that must embrace the digital transformation.

These conditions are perfect for leapfrogging directly from spreadsheets to superintelligent platforms. In our recent LatAm AI Benchmarks study, we found that more than 60% of new startups founded since 2023 were born AI-native and these companies are growing 1.6x faster than their non-AI peers. Besides that, what is even more exciting to us is the fact that the valuation premiums for AI companies remain modest at 10-20%, unlike in the US market, where AI commands valuation premiums of at least 40%10 due to deeper capital availability.

These dynamics make Latin America a rare environment to invest in fast-growing AI startups solving real problems at rational prices.

Our Approach to the AI Shift

“You will get rich by giving society what it wants but does not yet know how to get. At scale.” —Naval Ravikant

Super Intelligent Software is a new chapter in how software is built. It is reshaping foundational mechanics of the industry, and to stay ahead, we’ve begun evolving our frameworks. Although most of the implications of this shift are still unknown, here's some that we're already seeing and adapting for:

The traditional concept of ARR has to be reconsidered. In a world where pricing is increasingly tied to consumption and business outcomes rather than seat counts, revenue becomes less strictly recurring. We now assess recurrence based on consistent value delivery, rather than contract terms alone. The industry's definitions of ARR/MRR need to evolve to seize the opportunity.

Margins do not matter as much today as they did in the past. AI-SaaS companies often appear compressed due to high computing costs. But with a 100x drop in processing costs last year and more ahead11, today’s constrained margins may become tomorrow’s opportunity. These products will soon resemble SaaS again, but with faster feedback loops and greater upside.

Go-to-market is more challenging than ever. CACs are rising fast, and while building has become easier, distribution has grown significantly tougher. Yet, we’re seeing a new wave of products reach $10M+ in ARR in under three years by delivering 10x better solutions12. That level of traction used to be rare and now it’s increasingly within reach for those who build undeniable value.

What We’re Looking For

We’re raising the bar. With this new lens, we’re only committing when we see the potential for a company to define a vertical through Super Intelligent Software. That means:

Vertical AI-native platforms, deeply embedded in high-friction or labor-heavy workflows and designed to deliver measurable outcomes to their clients.

Scalable Professional Services Automation. Industries such as Legal, accounting, and consulting are language and process-heavy fields, perfect for AI. These sectors face high labor costs, repetitive tasks, and growing data complexity. Software that automates workflows can unlock massive value, with strong demand and willingness to pay.

Proprietary Small Language Models (SLMs) providing efficient and superior alternatives to massive foundational models. In healthcare, for example, agents built on SLMs can be trained exclusively on medical literature, patient records, and compliance protocols. By leveraging foundation models and evolving through fine-tuning, SLMs bring a clear path to specialized superintelligence at a fraction of the cost.

Pricing models aligned with client outcomes, ensuring consistent ROI and capturing a fair share of the value created. We're looking for software that can bridge from traditional IT budgets and eat into labor budgets.

Low friction, low-CAC distribution in times of inflationary CACs also deserves a premium. This is often delivered by the combination of a) Teams with sharp storytelling, deep expertise and strong founder-market fit and b) Ability to replace a legacy workflow with a 10x superior solution, that takes CACs close to 0.

Multimodal Interaction: Software now is expected to operate through text, audio, video, beyond traditional interfaces.

We are looking for platforms that are already delivering real value today, while laying the groundwork for superintelligence. The founders we’re drawn to are thinking several steps ahead, building with a clear view of what becomes possible in a world shaped by super abundant intelligence. This is the mindset we believe will define the next generation of outliers.

Why This Is Our Moment

There are no incumbents with a 20-year head start in this category. There is no Gartner Magic Quadrant. No playbooks. This creates a rare kind of opportunity, one where context, speed, and conviction matter more than pattern recognition.

We are underwriting a new software architecture. One that is intelligent, embedded, and capable of replacing work itself.

The next generation of multi-billion-dollar companies is being built right now. Getting in early, as we do, is the most asymmetric way to capture disproportional returns.

Thank you for your continued partnership.

Sincerely,

—The SaaSholic Team

This is a redacted version of our Letter from the GP from 1Q25, and does not include sensitive information due to confidentiality reasons

“The End of Software” campaign, Salesforce

“Vibe Revenues”, Greg Isenberg and Pat Grady

Where is the Budget for AI Coming From?, Tom Tunguz

A System of Agents brings Service-as-Software to life, Foundation Capital

Generative AI’s Act o1, Sequoia

Shopify CEO’s viral AI memo

There Are ~15 SaaS Private Decacorns, And 337 Unicorns, SaaStr. Full unicorn list: CB insights

SaaS Founder Ownership & VC Funding Metrics, Carta, Spring 2025

Cursor reaching $100M ARR within 12 months, the standout example of this new growth paradigm