AI Might be a Bubble (and this Doesn’t Matter)

A redacted version of our 3Q25 Letter from the GP

Over the past months a common view has formed in the market: AI is in a bubble. Record rounds and valuations, circular financing, blue-chip stocks jumping 40% in a single day and unprecedented capex all reinforce that view. In this letter we share how we see this debate and what it means for our strategy.

Our take is that the risk appetite across the market has clearly risen and there are visible pockets of excess emerging. We also acknowledge that we, like most of the market, lack the data to state anything definitive since only a fraction of information is public and the rest lives in rumor territory.

Despite the noise, we continue to believe AI is the next platform paradigm. It will allow software to capture larger shares of corporate budgets, generate more value per dollar invested, and replace labor meaningfully. We stay as bullish as ever on the applications emerging as the technology evolves, giving rise to Super Intelligent Software.

What reassures us as investors is that, while the world debates the AI mania, we are playing a different game in Latin America. Venture activity in the region is at decade lows and scarce capital and competition makes the “AI bubble” narrative far less relevant to our daily work. This gives us enough distance to look at the global picture without taking biased conclusions.

Is AI a Bubble? The Case for “Yes”

If you open any major media outlet or listen to investor conversations, you’ll find that most people already believe there is a bubble. Headlines say it, and sentiment surveys back it up.

Let’s break down the core arguments supporting that view:

Staggering Big-Tech Capex: Hyperscalers (Microsoft, Google, Amazon and Meta) are committing unprecedented sums to AI infrastructure, sometimes exceeding their entire current cash balances.

Capex as a share of GDP has already surpassed the dot-com bubble levels and trails only the railroad boom of the late 1800s, when rails reshaped how the world moved products and absorbed extraordinary amounts of capital. The concern is that today, these companies are overbuilding ahead of a demand that may never fully materialize.

A recent JP Morgan analysis1 estimated that, for these investments to yield a 10% return hurdle, the hyperscalers would need ~$650B in additional annual revenue through 2030, roughly 0.6% of the global GDP or the current combined revenues of Microsoft and Alphabet. At this scale, even small miscalculations can erase a lot of value.

Headline Reflex: Public markets became monothematic. If you’re perceived as an AI winner you go up; otherwise you shrug. Even blue-chip firms like Oracle have seen 40% single-day stock jumps after announcing new AI partnerships2, long before any execution shows up. When anything labeled “AI” surges in value overnight, we may be seeing speculative dynamics playing. Narratives are starting to matter more than fundamentals.

Circular Financing: Behind the stock charts, there are creative structures. Deals like Nvidia’s investment in OpenAI, tied to OpenAI’s commitment to purchase Nvidia’s GPUs3 raise questions about how much of the money reflects genuine value creation versus capital simply cycling between partners.

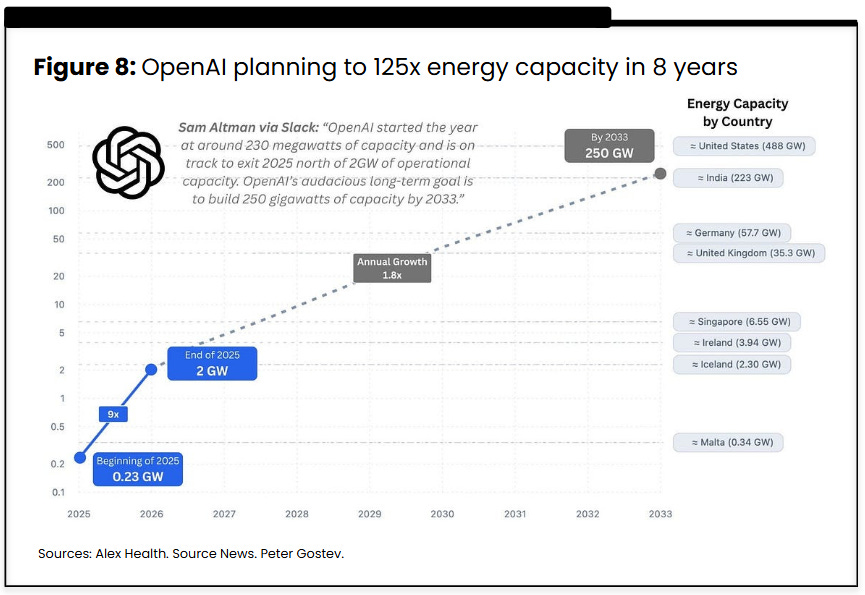

Grid-Sized Assumptions: OpenAI became the emblem of the scale of expectations. Projections suggest its compute demand alone could require power comparable to the entire US grid by the end of the decade. At the same time, the company has committed to invest $1.4T in the coming years, despite having around $20B in annualized revenues4 and no intention to become profitable anytime soon.

Taken at face value, these assumptions stretch today’s economics. By 2029, OpenAI would need to reach close to $600B in revenue for the math to make sense. As a comparison, Google currently has $350B in revenue and would reach a similar figure if it grows 12% annually until then5.

If nothing else, the planned spending and commitments present an enormous level of potential and ambition.

Mega-Rounds Math: The same exuberance spills into private markets. Record funding rounds and mega–funds are adding fuel to the fire and pushing expectations to extremes. Companies are hitting multi-billion-dollar valuations at incredibly early stages and platform-VCs are raising funds that require enormous exits to work.

Mira Murati’s Thinking Machines may be the prime example. The former OpenAI CTO has raised a $2B seed round at a $12B post-money valuation(!) with a16z, and is supposedly in talks to raise again at $50B, roughly 4x within months6.

The mega-fund math is also stretched. a16z recently raised $10B across different vehicles7. Assuming they own 10% of winners at exit they would need to return $120B to deliver 5X net returns to their LPs, implying $1.2T in total exit value8. For reference, this is almost the entire market cap of all US IPOs over the last five years.

Taken together, these points describe a market that looks like a bubble. Excesses are real and the risk tolerance has risen significantly.

Stopping the analysis here, however, is a short-sighted read of what is happening and misses the changes already underway.

The Case Against the Bubble

“The growth of the Internet will slow drastically (...) By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

- Paul Krugman, winner of the Nobel Prize in Economics, in 1998

History is full of confident calls that did not age well. It’s important to not throw the baby out with the bathwater and confuse the visible excess with a verdict on the technology itself. Recognizing that some behavior looks bubbly is different from dismissing structural shifts AI is already setting in motion. With that in mind, it is worth examining the arguments that support a more constructive view.

Trillions Optionality: the most bullish investors view the current capex through a macro lens. The “Gambling Man” of tech, Masa from Softbank, argues that AI could lift global GDP by 5-10%9. With 2025 global GDP around $180T, a 5% uplift would represent $9T of additional value per year. In that framing, the trillion-dollar infrastructure spend is rational, since today’s investments would be a relatively small price to pay for the potential upside.

This is far from our base case and sits on the most optimistic end of the range. Still, it explains why some investors are comfortable funding such aggressive buildouts.

Real Value is Being Created: behind the extreme rounds sits a product people love. ChatGPT launched less than three years ago and its relevance shows up in usage, retention, and revenue across the board. AI is being adopted faster and with broader reach than any prior technology.

ChatGPT’s retention curves make this even more explicit. Newer cohorts are performing better than earlier ones, which shows the product is compounding in quality and usefulness over time. As it improves, users come back more often and find new ways to use it. Even the weakest early cohorts settle above 50% retention more than two years after first use, something almost unheard of for a “single-player” product.

Hyperscalers Capex: Sources of Funding Matter. Earlier we framed hyperscalers’ capex as a potential euphoria sign. The other side of this story is the funding source. Today’s investments are largely financed by the vast free cash flow these companies generate, rather than by external sources. This is a sharp contrast with the dot-com era, when most spending relied on capital markets and cheap credit.

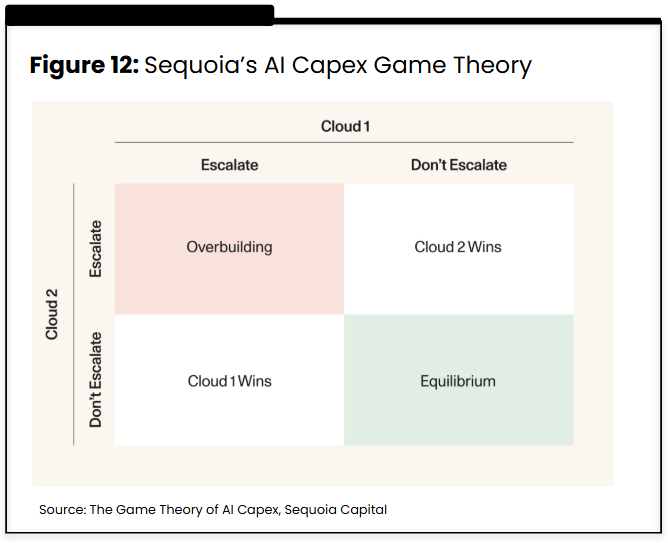

This does not guarantee that every dollar invested will earn attractive returns. It does mean that large, durable businesses are reinvesting their own profits into AI to protect and expand their core franchises. Some of this behavior is driven by game theory rather than clean spreadsheet logic.

In practice, the capex looks less like a financial exercise and more like an arms race. None of the hyperscalers can risk falling behind their closest peers, which helps explain why spending keeps accelerating even as the numbers look stretched10.

These companies also know how expensive it is to miss a platform shift. Microsoft and Google have already watched Apple dominate mobile, despite their scale and resources. AWS is now starting from behind in the AI race, while Azure and GCP gain share as the “AI clouds”. Meta can feel the risk as OpenAI moves into B2C with products like Sora competing directly for user attention and screen time.

With that backdrop, the cost of sitting out the next tidal wave looks far higher than a few years of over-investing their own cash flows, even if that means accepting lower returns on some of this capex.

There is an additional caveat to the “overbuilding” story. Capex is rising fast, but contracted demand is rising just as quickly. Cloud backlogs (or RPO), which represent revenue that is already signed but not yet recognized are growing at roughly the same pace as spend:

Azure: capex rising from about $44.5B in 2024 to $65B this year, up 45%, while backlog is up 51% to $392B.

AWS: capex increasing from $78B to $125B, up 61%, with backlog around $200B in signed contracts.

Google Cloud: capex moving from $52B to $92B, up 75%, and backlog jumping 82% to $158B11.

These numbers show that a large share of the current buildout is already backed by contracted demand. The constraint today is compute supply, not demand, which makes the overbuilding argument less convincing than it first appears.

Larger Outcomes: There is also a history of outcomes exceeding prior standards. In August 2018, Apple became the first company to reach a $1T valuation12. Fast-forward to today, there are a dozen companies above that threshold, with one of them above $5T.

The size of the winners keep getting larger as adoption compounds, but investors frequently underestimate how big the category winners can become.

Multiples are High, but Nowhere Near Dot-Com: valuations have, in fact, moved up in recent years. Nasdaq’s next-twelve-months P/E is ~30% above its 10-year average, however, it’s still roughly 3x below dot-com levels. The same gap appears when we compare today’s winners with the leaders of that era.

Nvidia, often treated as the poster child for the AI bubble, has seen most of its value appreciation driven by earnings growth rather than multiple expansion. Price has moved, but so has the underlying business, which keeps beating earnings expectations quarter after quarter.

AI is the only game in town: Public markets look monothematic because AI has become the primary driver of growth. Large companies cannot afford to ignore AI or sit on the sidelines while real revenue is already coming in and growing.

AI infrastructure has overtaken SaaS as the main source of net new revenue. The concentration of attention on AI may be a feature of where growth truly resides, not only a symptom of speculation.

Operating Leverage Proof Points: tangible gains are already visible. One of the clearest signals is in entry-level roles. In functions highly exposed to automation, such as software engineering and customer success, the traditional “first job” is frequently not being opened because teams are being redesigned around smaller, more senior groups supported by AI tools. Companies are shipping more with fewer people, payroll in those functions is shrinking and efficiency is improving.

Today’s AI is the Worst AI We Will Have: AI scaling laws13 make each generation of model more capable and autonomous, handling a broader set of tasks without intervention. We must keep in mind that the impact we are seeing comes from the least capable versions of these systems. As they improve, new categories, products, and workflows will become viable to automate. The most exciting part is that this intelligence is accessible anywhere in the world, just an API call away.

The Bay Area is not the Whole Word: media coverage tends to focus on outliers. If you only read the headlines, it is easy to believe that every AI deal is a unicorn at seed. Aggregate data tells a more nuanced story.

Carta’s VC funding distribution data shows that median and even top quartile valuations sit in line with historical ranges. The top decile and percentile run far ahead prior norms, and those are the rounds that generate headlines and social media buzz. A large share of the excess appears concentrated in this slice at the top of the distribution.

There are still questions we cannot fully answer, such as whether circular financing structures or the most exuberant rounds will ultimately pay off. Despite these unresolved concerns, AI’s underlying results are hard to ignore. Products are being used at scale and only improving, revenue is compounding while costs trend down, and entire workflows are being reshaped. Taken together, these signs make us believe the outcomes of this cycle can be incredibly compelling.

What About LatAm?

Until now, we wanted to provide our overview on the current market. It is equally important to note that much of this has limited impact on our day-to-day decisions as early-stage investors in LatAm.

Latam sits outside the global hype loop. Funding is at ten-year lows and there is simply not enough fuel to inflate a real bubble here. Ultra-competitive rounds that close over a weekend do not exist. Valuations in most cases are grounded, competition for deals is manageable and we can still back top-tier AI founders at fair terms.

Additionally, most of the bubble concerns we discussed relate to foundational models and infrastructure buildout. These are arenas where Latam lacks the capital to compete at a global scale (and that’s fine). Our edge here is to leverage this ever-improving technology to create value at the application layer. This is where we combine global building blocks with local data, workflows and distribution to create products that solve real problems for end-users.

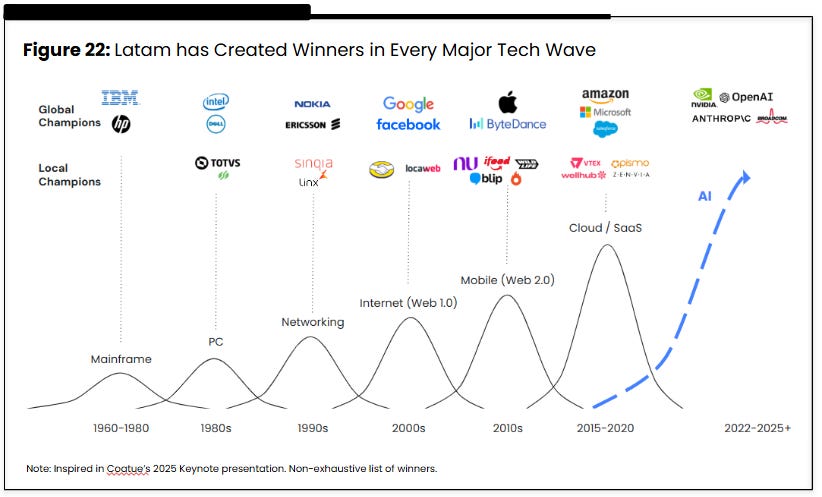

Every major technology wave has produced both global and Latam winners and we expect AI to follow the same pattern. The common thread is local winners have historically emerged at the application layer because regulation, customer behavior, language, financial rails and compliance here are unique and require deep in-market understanding.

All prior waves, from on-prem and e-commerce to fintech and SaaS, created regional champions built around these specifics. AI will be no different.

We remain focused on the fundamentals. AI is a transformative wave that will reshape software economics, and we are investing for that future. Latin America is still vastly underpenetrated by technology, often because it has been easier to “throw people at problems” than to automate work. AI changes that equation by moving software from a simple productivity tool to agents that actually execute the work faster and cheaper. Together with every management team we meet exploring how to implement AI, the setup for leapfrogging is strong.

AI, after all, will become similar to electricity and the internet: taken-for-granted technology that all businesses will use and won’t remember how it was like operating without it.

Seen from this angle, there is even a case that a “bubble” could end up being positive for our region. As global players race to deploy AI infra, they compete to drive down compute costs through scale, better hardware and more energy-efficient solutions. If demand ultimately falls short of expectations, that extra capacity and efficiency will translate into lower prices for consumers of compute. Another powerful tailwind for the Latam application layer.

Where we are Navigating towards

We are laser-focused on verticals where software can replace labor, embedding AI into complex workflows. As discussed in Doing It Wrong, Again, we are looking for:

Vertical, AI-native platforms in labor-intensive workflows. Replacing pen-and-paper and spreadsheets in complex industries to deliver huge improvements in speed, accuracy and economics.

Scalable professional services automation. Law, accounting, finance, consulting and other language / process-heavy fields, where high labor costs and repetitive work make them natural candidates for AI agents.

Proprietary Small Language Models (SLMs) tuned on domain data. Companies that can accumulate the largest pools of proprietary, vertical-specific data and use reinforcement learning to turn that data into products that are 10x better than what any horizontal player or generic model provider can deliver, at a fraction of the cost.

Pricing models aligned with client outcomes. Ensuring clear ROI and capturing a fair share of the value created. Software that can bridge from traditional IT budgets and eat into labor budgets.

Low-friction, low-CAC distribution. Powered by teams with sharp storytelling, deep field expertise and founder-market fit, often paired with multimodal interfaces (text, voice, video) that meet users where work already happens.

Geographic and regulatory barriers. Since capital in Latam is scarce, global competitors will often be more funded. We favor business models where local context, regulation, compliance and market structure create natural moats and make it harder for foreign players to compete on equal terms.

For us, this is where the real edge lies, and the bubble debate matters far less than it may seem at first glance. We acknowledge that some parts of the market look excessive, and our response is simple: we stay out of the rounds where exuberance dominates. What matters is staying disciplined, meeting our target ownership and working closely to our founders to help them win.

Some of those exuberant bets may still work; whether they do or not, we are comfortable watching from the sidelines.

AI Capex - Financing the Investment Cycle, JP Morgan, Nov-2025

Although there has been a large correction since then. Oracle is already underwater on its ‘astonishing’ $300bn OpenAI deal, Financial Times.

Other mega-raises are $7B for Lightspeed and $8B for General Catalyst. a16z’s raises are divided as: $6B growth fund, $1.5B AI apps fund, $1.5B AI infrastructure fund and $1B defense fund, according to SaaStr.

We acknowledge that LPs in these mega-funds underwrite 2-3X net returns over a shorter time horizon instead of the traditional 5X over 10-12 years. Even with these lower targets and compressed timelines, the simple math highlights how dramatically the venture game has changed.

Data from the companies’ public fillings. Extracted from A saúde das empresas de tecnologia, Bits, Stocks & Blocks.

https://open.substack.com/pub/evolvingtheory/p/the-ai-bubble-isnt-the-dot-com-bubble-b0d?utm_source=share&utm_medium=android&r=275w0u